Ever puzzled what occurs when a credit score buyer goes into default, doesn’t repay their mortgage, and what meaning on your returns? Properly, as we speak, that’s precisely the subject we’re diving into.

As a part of our investor group, you deserve clear, trustworthy insights into how your cash is performing, together with relating to the extra complicated subject of defaults.

Bondora Group is in its strongest place ever, with a transparent technique for continued development. A key signal of that progress is the regular enchancment in our default fee. However what does “default” truly imply? How will we measure it, and the way does it relate to the well being of our present portfolio and your funding?

Let’s have a look behind the numbers.

What’s a default?

A mortgage is taken into account in default when funds are greater than 90 days overdue, and the contract with the client is terminated as a result of the account is in arrears for an overdue interval.

However a default doesn’t imply cash misplaced. It’s the purpose the place our restoration efforts start, with the intention of recovering as a lot of the excellent quantity as potential. On common, in some nations, we’re in a position to get better as much as 70% of the defaulted quantity, one thing we’ll discover extra in an upcoming weblog publish.

It’s very important to acknowledge that our aim is to deal with each credit score buyer with respect and equity all through the restoration course of. We perceive that monetary challenges can occur, and our restoration technique balances accountable lending with compassionate debt administration.

To raised perceive the potential influence of defaults, we additionally study Loss Given Default (LGD), which displays the remaining loss after anticipated recoveries. This helps assess the portfolio’s long-term well being.

PD12: A key danger metric

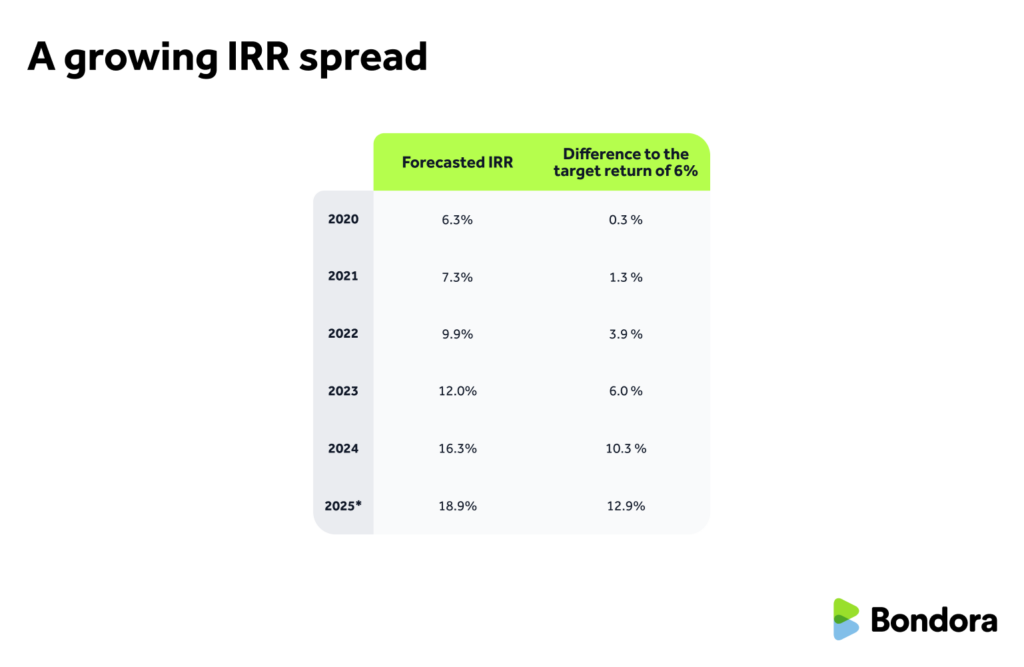

In a earlier article, we defined how we forecast our inner fee of return (IRR) and shared some key particulars. Now, we’d prefer to go additional by presenting our forecasted IRR over a extra prolonged interval and providing insights on PD12, a key metric utilized in IRR calculations.

PD12 measures the precise default fee inside 12 months of when a mortgage is issued. It acts as a number one indicator of credit score danger and is a key consider calculating our forecasted inner fee of return (IRR).

We’re inspired to see that our PD12 outcomes have steadily improved, reflecting higher danger fashions and extra considerate borrower analysis.

A rising IRR unfold

Even when accounting for defaults and recoveries, our forecasted IRR continues to point out a wholesome unfold above the 6% Go & Develop goal return.Right here’s how that forecasted IRR has advanced over the previous 5 years:

*Forecast based mostly on present mortgage efficiency and assumptions of the partial yr’s knowledge.

This unfold has been steadily rising, reflecting enhancements in credit score danger management and the general energy of the portfolio. These elements reinforce Bondora’s capacity to ship two stuff you worth enormously: steady, sustainable long-term returns and near-instant liquidity.

The consolidation of Go & Develop, our flagship product, and the distinctive challenges of the COVID years formed our present portfolio strategy. Regardless of headwinds, like Finland’s restrictive curiosity ceiling, we strengthened our underwriting fashions and refined our portfolio methods.

Bondora’s evolution is a narrative of development by studying. Challenges from earlier years have led to raised techniques, smarter danger fashions, and stronger efficiency. Decrease default charges and a strong danger framework now outline our operations.

As our Chief Credit score Officer Juris Rieksts-Riekstiņš explains:

“Since Q3 2023, we’ve achieved our widest-ever unfold between mortgage defaults and curiosity charged throughout all our markets, a transparent win for credit score danger management.”

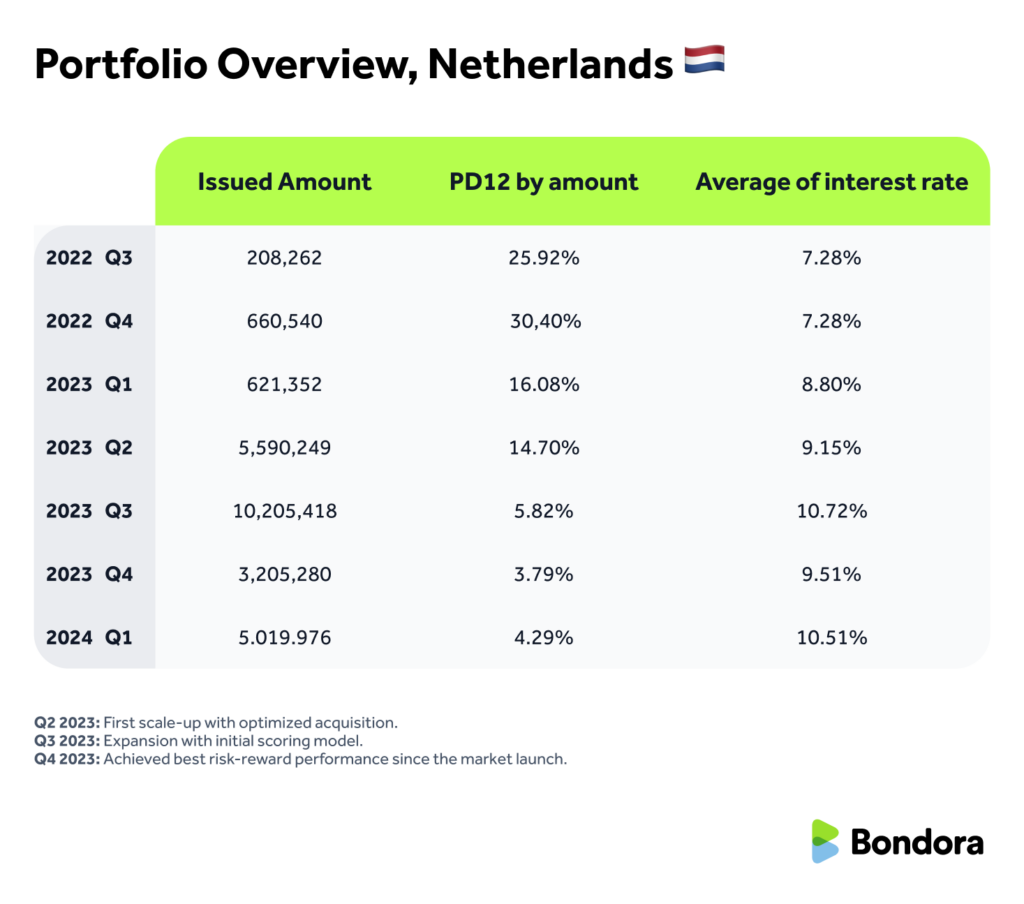

A shining instance of this adaptability is the Netherlands, the place we reached high-performance danger metrics inside just some quarters. Extra on that beneath.

Market-specific efficiency tendencies

Right here’s a snapshot of how our efficiency is evolving throughout key markets.

Be aware: Q2 2024 stats shall be accessible after Q2 2025, because of the required 12-month remark interval to categorise defaults precisely.:

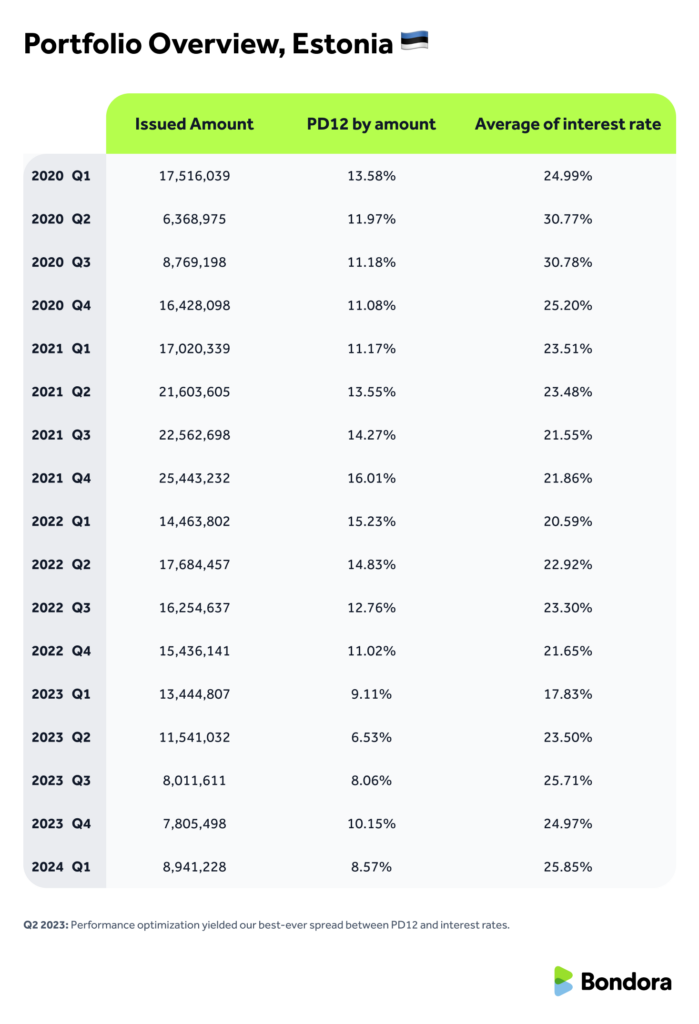

🇪🇪 Estonia

- Q2 2023: Efficiency optimization led to our best-ever unfold between PD12 and rates of interest.

- At present’s Estonian portfolio is extra steady and predictable than in earlier years.

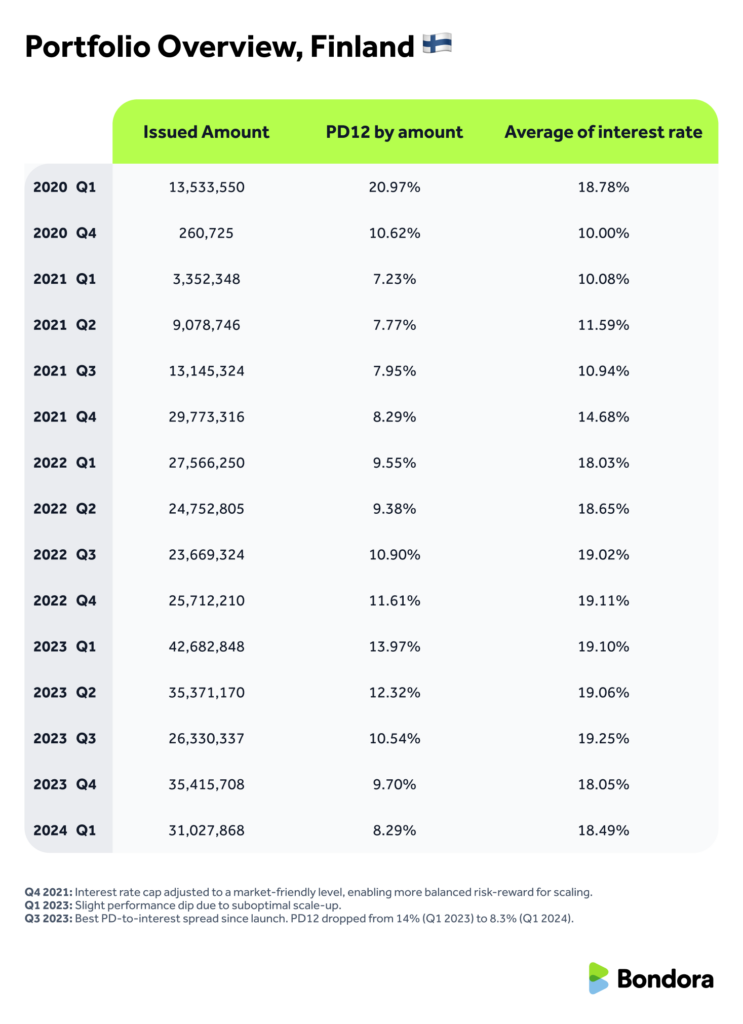

🇫🇮 Finland

- This autumn 2021: Rate of interest cap adjusted, making a more healthy risk-reward steadiness for scaling.

- Q1 2023: A slight momentary dip as we scaled operations.

- Q3 2023–Q1 2024: Vital enchancment when PD12 fell from 14% to eight.3%, the most effective unfold since market launch.

- Finland now persistently represents almost 70% of our complete portfolio, making these enhancements particularly significant.

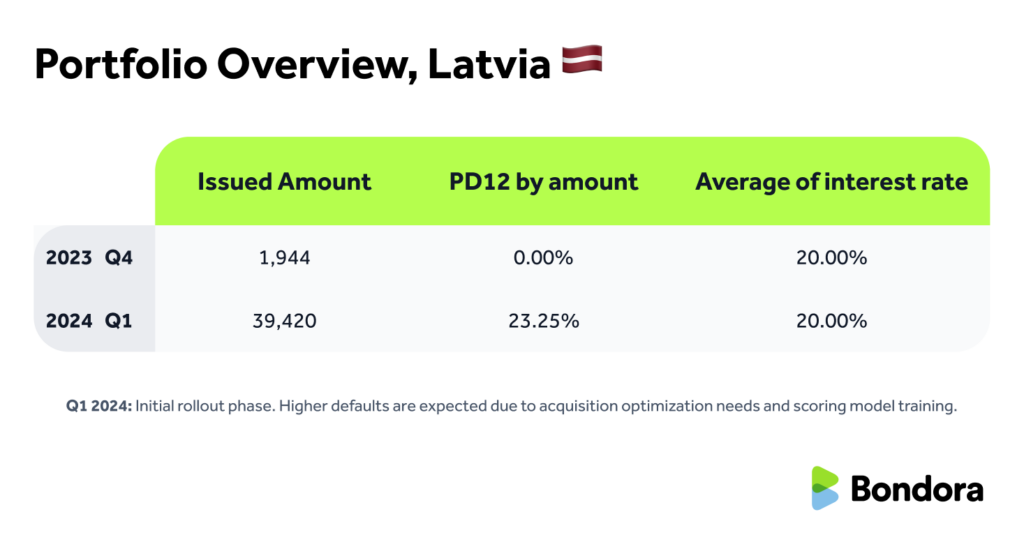

🇱🇻 Latvia

- Q1 2024: Early-stage market. Larger default charges are anticipated on this part as we optimize acquisition and enhance scoring accuracy.

🇳🇱 Netherlands

- Q2 2023: First scale-up with optimized acquisition.

- Q3 2023: Growth with preliminary scoring mannequin.

- This autumn 2023: Achieved greatest risk-reward efficiency for the reason that market launch.

Throughout all markets, our portfolio continues to enhance, with the share of defaulted loans steadily reducing. This pattern displays the influence of our ongoing efforts to reinforce portfolio well being by higher danger administration.

Trying again to maneuver ahead

Reflecting on previous outcomes and analyzing historic knowledge permits us to study from actual expertise and make the mandatory changes for an excellent higher future.

On the core of our knowledge sharing lies our dedication to transparency. We’ll proceed to share key insights with you in our common month-to-month stats weblog posts, real-time updates on our revamped Statistics web page, and in additional in-depth articles like this one, which breaks down the numbers even additional.

In a future weblog publish, we’ll discover how we handle the restoration course of, from respectful communication with debtors to the techniques we use to get better funds pretty and responsibly.

📣 Have a query about defaults or our statistics?

Share your ideas by way of the suggestions type and assist form what we share subsequent.